Tx Franchise Tax Instructions 2024 Pdf

Tx Franchise Tax Instructions 2024 Pdf. Texas franchise tax instructions 2024. 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due. Texas franchise tax instructions 2024.

Tx Franchise Tax Instructions 2024 Pdf Images References :

Source: simonewlayla.pages.dev

Source: simonewlayla.pages.dev

Texas Franchise Tax 2024 Lusa, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

Source: maudqbernita.pages.dev

Source: maudqbernita.pages.dev

2024 Texas Franchise Tax Report Instructions Gilli, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

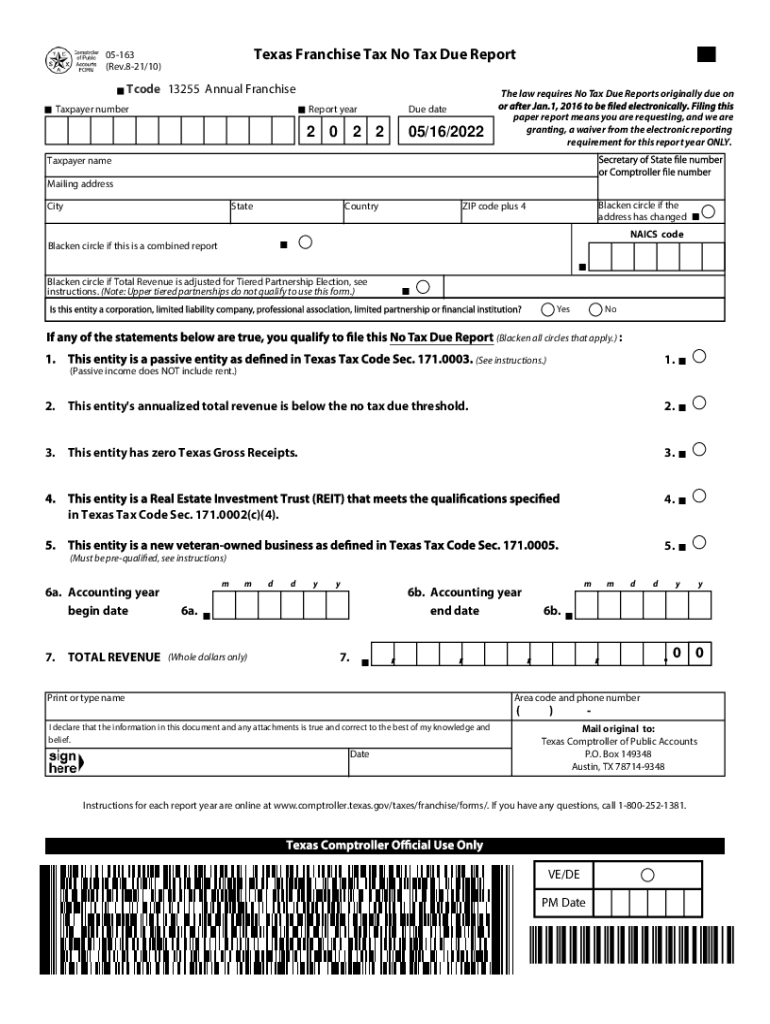

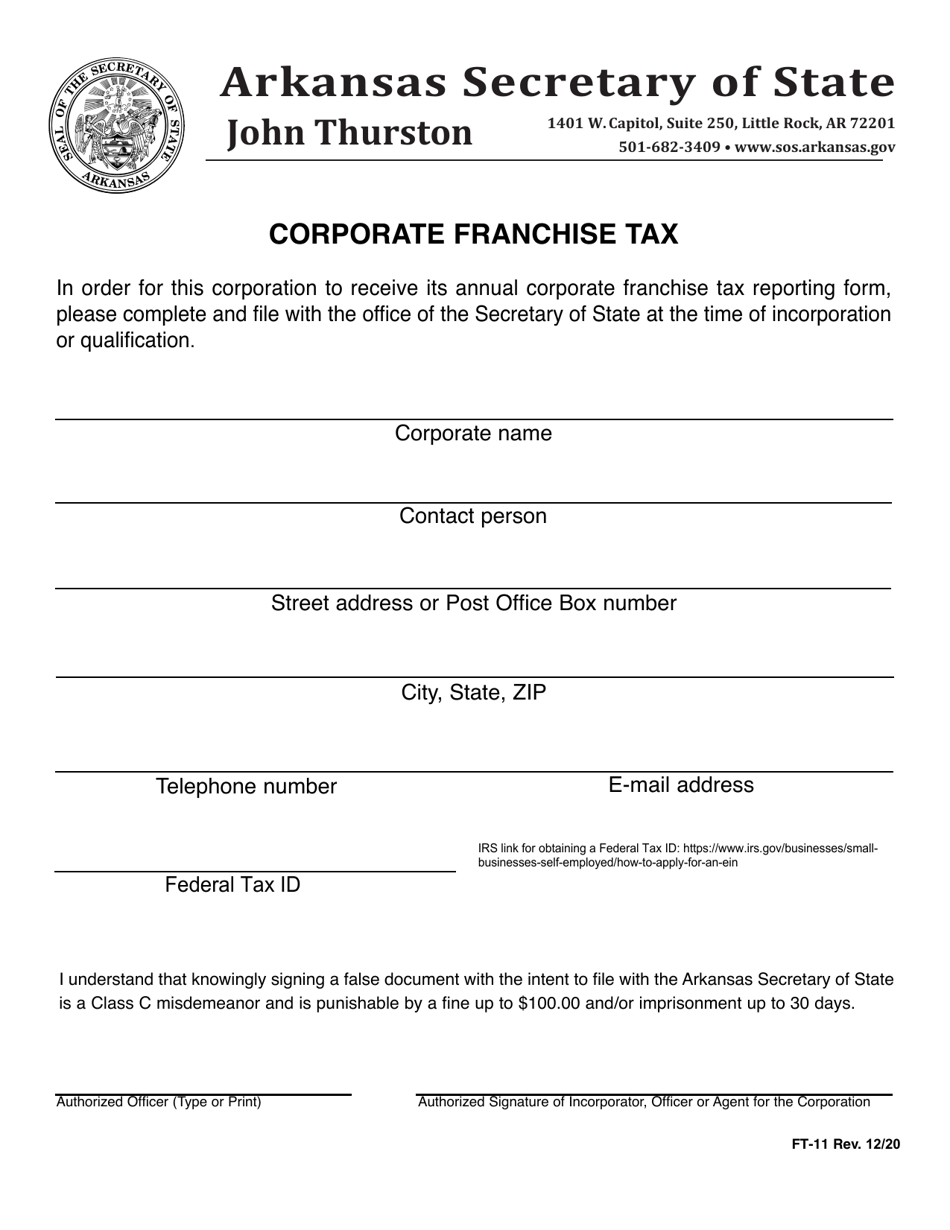

Source: www.signnow.com

Source: www.signnow.com

Tx Franchise Tax for 05 169 20182024 Form Fill Out and Sign, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

Source: simonewlayla.pages.dev

Source: simonewlayla.pages.dev

Texas Franchise Tax 2024 Lusa, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

Source: sashenkawanabel.pages.dev

Source: sashenkawanabel.pages.dev

Texas Franchise Tax Form 2024 Lara Sharai, Texas franchise tax instructions 2024.

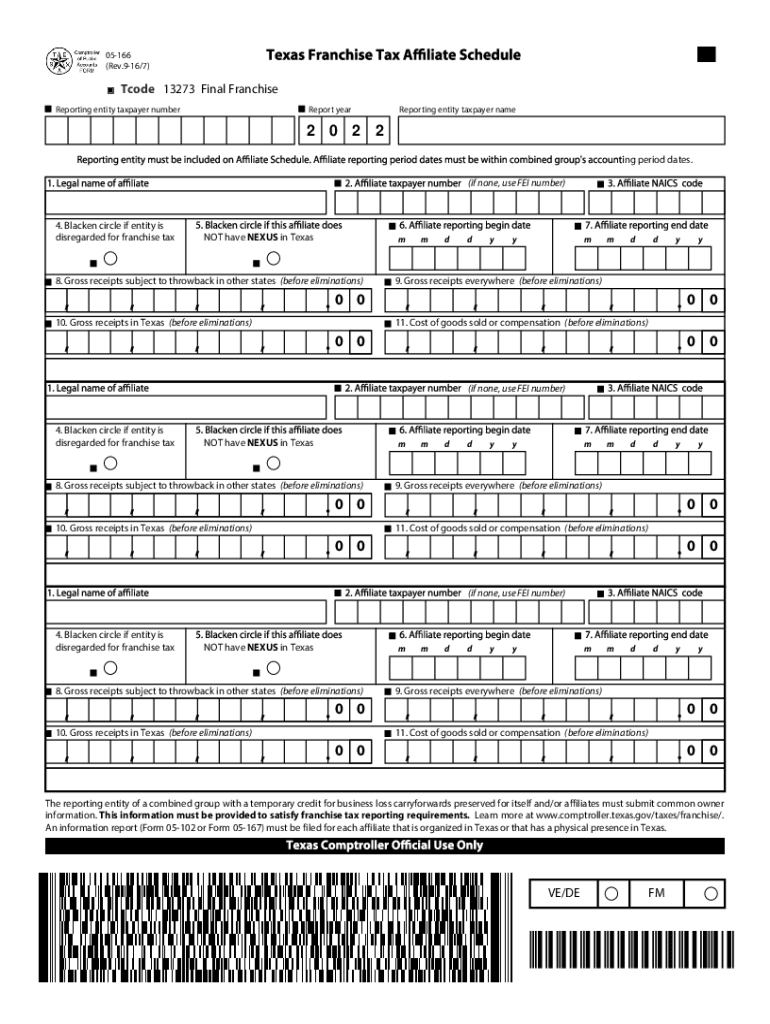

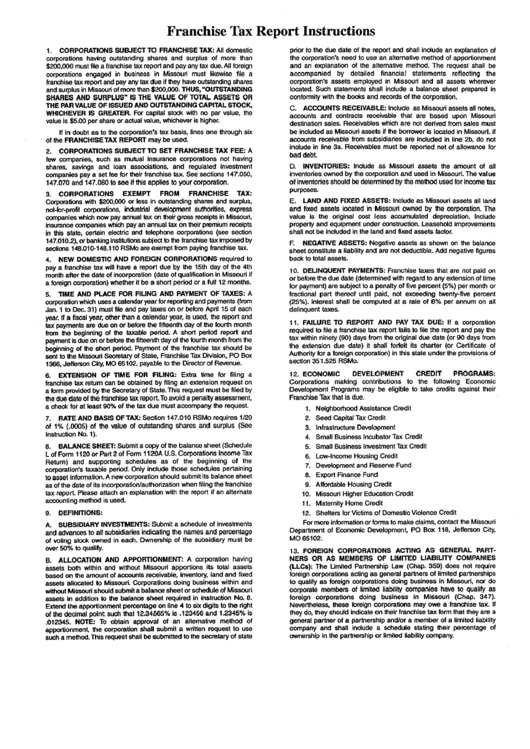

Source: www.formsbank.com

Source: www.formsbank.com

Franchise Tax Report Instructions printable pdf download, Texas franchise tax instructions 2024.

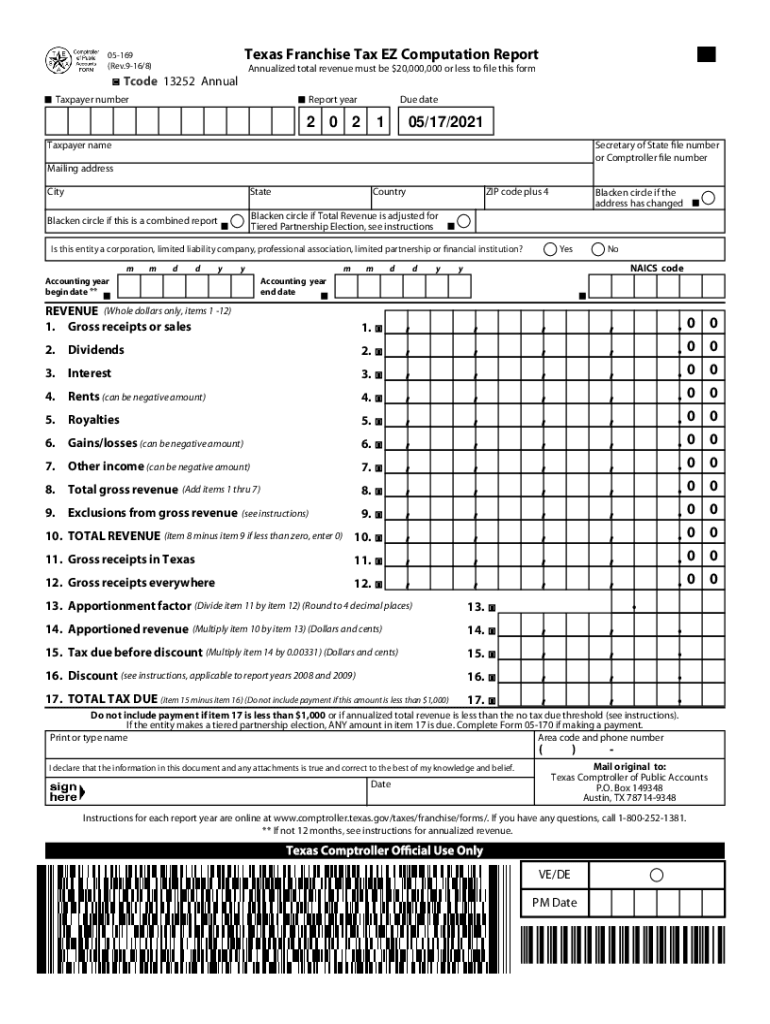

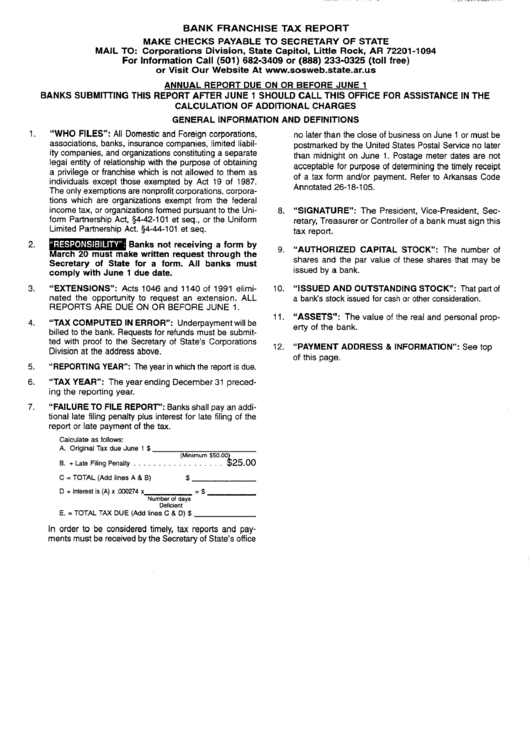

Source: www.formsbank.com

Source: www.formsbank.com

Bank Franchise Tax Report Form Instructions printable pdf download, Texas franchise tax instructions 2024.

Source: maudqbernita.pages.dev

Source: maudqbernita.pages.dev

2024 Texas Franchise Tax Report Instructions Gilli, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

Source: sashenkawanabel.pages.dev

Source: sashenkawanabel.pages.dev

Texas Franchise Tax Form 2024 Lara Sharai, Texas franchise tax instructions 2024.

Source: koressawshina.pages.dev

Source: koressawshina.pages.dev

Texas Franchise Tax Rate 2024 Lita Genovera, 1, 2024, a taxable entity whose annualized total revenue is less than or equal to $2.47 million is no longer required to file a no tax due.

Category: 2024